Table of Contents

Introduction

Hong Kong is one of the most important ports in Asia for shipping cargo. Its international seaport and airport are major hubs for shipping goods from China. Since China and Hong Kong are linked by road to the city of Shenzhen, we can say that all freight methods can be used between the two places. So, you can choose the best method depending on the type and amount of goods you are sending, also regarding the origin in China. Our shipping experts will determine which method is best for you.

Our team is a group of experts who know how Hong Kong’s bureaucracy works and are professionals in managing customs. They will take care of getting your goods cleared. Our customs brokers will take care of all the paperwork, making it easier for you to import or export goods. They will also handle any issues with customs on your behalf, saving you lots of time and money.

list of documents required to import goods from Hong Kong

In this article we provided a list of various documents that you will need in the procedure of international trade. You must know that to run things smoothly, you will have to know what each document is for and why you need it.

what are the Commercial Documents for shipping from Hong Kong?

Several commercial documents are used for global commerce during trades between companies. Here is a list of documents that are used during the customs clearance process:

Manifestation

the quotation has to include the following information :

- the goods that are sold

- the price of it

- quality

- quantity

- terms of trade

- terms of delivery

- terms of payment

All these have to be provided by the exporter.

ProForma Invoice

A pro forma invoice is a quote that looks like an invoice. The buyer may need it to apply for an import license, set up a pre-shipment inspection, open a letter of credit, or transfer hard currency.

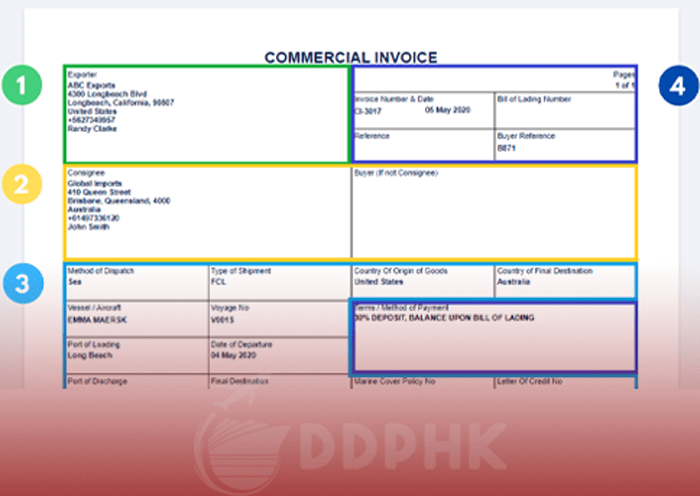

Commercial Invoice

You will need the commercial invoice to show that the sale has been made between seller and buyer. When you use it as an export documents through customs clearance. It is used for calculations of duties and taxes that need to be paid.

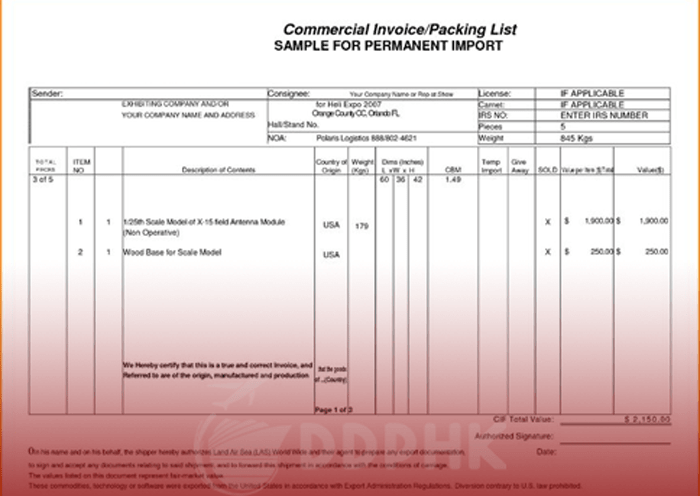

Packing List

In international shipping, a packing list is a form used to tell the exporter, freight forwarder, and final consignee about the shipment, such as how it’s packed, the volume and weight of each box, and what marks and numbers are labeled on the boxes.

Certificate Of Inspection

The document, called an “inspection certificate” is used to show that shipped goods have been checked to make sure they meet the terms of the sales contract. And has to be provided by an inspection company or the exporter.

Insurance Policy

The insurance company pays for the losses the insured may have to pay for in certain situations.

Insurance Certificate

This shows that you have insured the cargo. And it will be covered by the insurer if the cargo is lost or damaged while in transit.

Product Testing Certificate

Health Certificate, Phytosanitary Certificate, Fumigation Certificate: we will explain this later under the title of specific goods.

Consular Invoice

It describes the cargo and gives details like the sender, the recipient, and the value of the shipment.

Transport Documents

Transport documents are documents that give information about the cargo that is being shipped.

Shipping Order S/O

A document that has information about the cargo and the shipper’s inquiry. It is used to make other transportation documents, like a bill of lading, an air waybill, etc.

Dock Receipt D/R or Mate’s Receipt

A mate receipt is given by the ship’s captain when cargo is loaded on board. It lists the name of the ship, its docks, the date of shipping, the characterization of the packages, their signs and numbers, and the condition of the cargo when it was loaded on deck.

Bill of Lading (B/L)

It represents a complete description of the goods being shipped given to the person sending the goods by the carrier as a receipt. It can be used as a contract for transporting goods, as a receipt for the goods being moved, and as proof of ownership.

House Bill of Lading (Groupage)

A House Bill of Lading (BOL) is made by an Ocean Transport Intermediary (OTI), like a shipping company or non-vessel operating company (NVOCC). It is given to the seller once the cargo has been received to let them know that their items for shipment have been collected. To say it simply, It’s a receipt for the shipments,

Sea Waybill

A seaway bill is an approval for goods that are given to the client by the ocean carrier (also known as the consignor or shipper). The sea waybill is good for regular cargo between associated companies that don’t need bank transfers or other third parties.

Air Waybill (AWB)

An air waybill (AWB) goes with shipments by an international air freight company. It contains detailed information about the shipment and lets it be tracked.

House Air Waybill (HAWB)

An air shipment note is a document that an air freight agent gives to describe and keep track of the cargo. Again, it’s not an official title.

Shipping Guarantee

A shipping Guarantee is a guarantee on paper from the bank that will share liability. It is given to the carrier or its agent by the importer so that the goods can be picked up if the cargo arrives before the shipping documents.

Financial Documents

These are the documents that demonstrate the terms of payments and anything related to that:

Documentary Credit D/C

A documentary credit is a way of paying for a sale that protects both the seller (the exporter) and the buyer (the importer). It’s when the buyer’s bank promises to pay the supplier as long as the seller meets the terms outlined in the L/C.

Standby Credit

A document, usually from a bank promises to pay one party to a contract (the beneficiary) if the other party doesn’t perform the contract or is accused of not doing so.

Collection Instruction

A documentary collection (D/C) is a type of money transfer in which the exporter tells the exporter’s bank (the “remitting bank”) to collect payment. The exporter’s bank then sends documents and payment instructions to the importer’s bank (the “collecting bank”).

Bill of Exchange (B/E) or Draft

A written order from an importer to an exporter says the importer must pay a certain amount of money to the order of a person or bearer on demand or later. This order is binding and cannot be changed.

Trust Receipt (T/R)

A trust receipt is a statement that shows a bank has released goods to a buyer but that the bank still owns the goods that were released.

Government Documents

There are some certifications that you must provide for the customs clearance process:

Certificate of Origin (CO)

A Certificate of Origin (CO) is one of the most important international trade documents that shows that all of the goods in an export shipment originated from, were produced in, or were processed in one country.

Import / Export Declaration

An exporter fills out a form called an “export declaration” and turns it in at the port of export. It gives information about the type, number, and value of the goods being shipped. Customs uses this data to control exports, in addition to gathering statistical data about a country’s world trade

Import / Export License

A document from a government organization that permits the trader to import or export certain goods.

International Import Certificate (IIC)

A statement from the government of the country where the strategic goods will be used that says the goods will be released there. It is only given out in Hong Kong to meet the needs of a country that is exporting.

Delivery Verification Certificate (DVC)

A form that proves a manufacturing drawback claim and tracks imported goods from the hands of the importer to the hands of the manufacturer.

Landing Certificate

A document from the destination country’s government says a specific item has arrived in that country.

Customs Invoice

On an invoice, you can see who the buyer and seller of the goods are, what the items are, how much they cost, and what the terms of the sale are or what they are supposed to be. Invoices are used by many governments to figure out customs duties and taxes.shouldn’

What makes importing from Hong Kong much easier for you? (in comparison with the mainland way or inland way)

Always try to pay as little tax as possible. To get the best deal on taxes and business in China, we can look at employing Hong Kong as an export gateway.

Most of the things that are brought into Hong Kong are tax-free. Taxes are only on tobacco products, alcoholic beverages, hydrocarbon oil, and methyl alcohol.

Rules and limitations for importing from Hong Kong

Generally, import and export are easy through Hong Kong customs, but there are certain limitations that you shouldn’t overlook.

- Prohibited goods:

Even though Hong Kong is a free port, you can’t just send anything through its customs. There are still some things that can’t be brought into the country, just like there are some things that shipping companies won’t take. You can find out what you can’t send by courier by looking at ParcelCompare’s list of restricted goods. Hong Kong doesn’t have many banned items, but there are some things that you need authorization to bring in:

- Radioactive materials

- cellphones

- Dangerous chemicals.

- Animals or related goods

- Diamonds

- Pesticides

- Weapons, weaponry, and bombs

- Medicals

- Particular Goods:

- Health Certificate: When agricultural or food products are exported, the country in charge issues a document to prove that they follow the laws in the exporter’s country, are in good condition when inspected before shipping, and are safe for human consumption.

- Phytosanitary Certificate: It is often an international rule that any shipment of plants or planting materials coming into a country must come with a Phytosanitary Certificate from the government that sent the shipment. This certificate says that the load was found to be mostly free of diseases and pests and that it meets the phytosanitary regulations of the destination country. So it would be best if you went to the Agriculture and Fisheries Department in Hong Kong to ask for the certificate.

- Fumigation Certificate: A pest control certificate proves that the products in question have been fumigated by an approved fumigation service provider during quarantine and before shipping.

Last word

Door-to-door is the easiest way to handle logistics that don’t involve you with any stressful bureaucracy or arrangements for transportation and delivery. As the name suggests, we will be in charge of getting your goods from where they are manufactured to where you live. We will take care of all the stages that may be needed, such as customs clearance, shipping goods, warehousing, decanting, etc., so the best choice will be to lie back in your seat and let us do the hard work.

Our customs broker team is responsible for :

- Send Customs the proper paperwork for every situation to ensure your goods are allowed to pass through..

- If Customs wants to check on your cargo, we will go there as your representative and make sure everything is done right.

- We can save you time and money by making the customs procedures easier.